Recapture Rule (Save Our Homes)

It is a common misconception in Florida that if your property’s just/market value decreases, that your taxes will also decrease for that year.

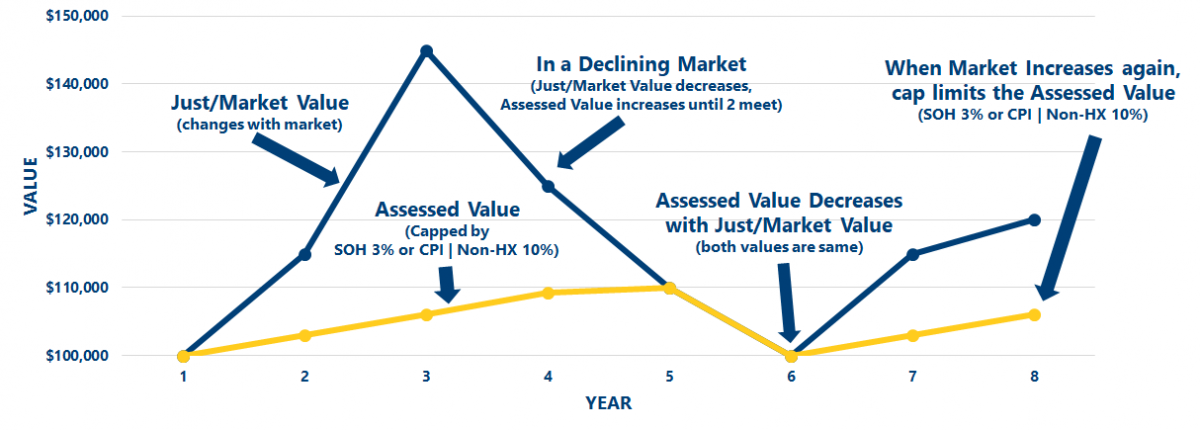

Under Florida Law, properties are allowed a limit on the amount the assessed value may increase each year, known as the homestead Save Our Homes (SOH) 3% cap and the non-homestead 10% cap. Over time, these caps can reduce the amount of property taxes paid as they are calculated on assessed value.

The ‘recapture rule’ may apply if the just/market value of the property decreases. The assessed value will still increase by 3% (homestead) or 10% (non-homestead) annually until it reaches the just/market value. Assessed value can never be more than just/market value. When the just/market value increases, the applicable cap will again limit future increases of the assessed value.

This graph illustrates the effect for a homesteaded property with the 3% SOH cap.

More information about the recapture rule can be viewed at Florida Statutes 193.155; 193.1554. Florida Administrative Code 12D-8.0062