Repair or Replace Calamity Damaged or Destroyed Property

My home has been damaged due to a Hurricane. Will my property's assessed value increase if I repair or rebuild my home?

Under Florida Law, if a property is damaged or destroyed by misfortune or calamity, the property owner may continue the homestead exemption after the damage or destruction occurs. The calamity provision in Florida Law protects property owners from an increase in their assessed value following a catastrophe when repairing/rebuilding their property. The owner must notify the Property Appraiser that they intend to repair or rebuild the property and use the property as the primary residence following completion.

Please review the following scenarios to better understand how this may impact your property taxes:

- Elect not to rebuild - If homesteaded, the exemption will be removed on the January 1 following the damage, and the property owner will have a window of 3-tax years beginning on the January 1 following the damage event to port (transfer) any Save-Our-Homes (SOH) assessment differential to a new homestead. Properties without a homestead exemption will maintain the 10% non-homestead cap.

- Repair - If the property owner makes necessary repairs and reoccupies the property, there will be no impact to the assessed value cap. Please note: FEMA and Florida Building Code may require elevation of residential structures if they are located within a Special Flood Hazard Area and the cost of repairs equals or exceeds 50% (or 49%) of the depreciated value of the structure.

- Elevate & Repair or Rebuild (flooded properties) - If the property owner elevates (lifts) the lowest living level of the structure above base flood elevation, converts the at grade level from living to parking/storage/access and builds above, or builds a new code compliant structure, the improvements that are elevated will remain under the cap if they do not exceed the respective calamity allowance for their property per Florida statutes. In addition, the value of the newly constructed subarea(s) at grade level will not be added above the assessed value cap if the at grade area does not exceed the respective calamity allowance based on the original living area of the damaged home, provided the at grade area is only used for parking, storage, covered porch, or access to the upper stories. The respective calamity allowances per statute are as follows:

- Construction completed in 2024 tax year or prior - 110% of the original structure’s living area or 1,500 SF, whichever is greater – applies to both Homestead and Non-Homestead Property

- Construction completed in 2025 tax year or later - 130% of the original structure’s living area or 2,000 SF, whichever is greater – applies to Homestead Property Only

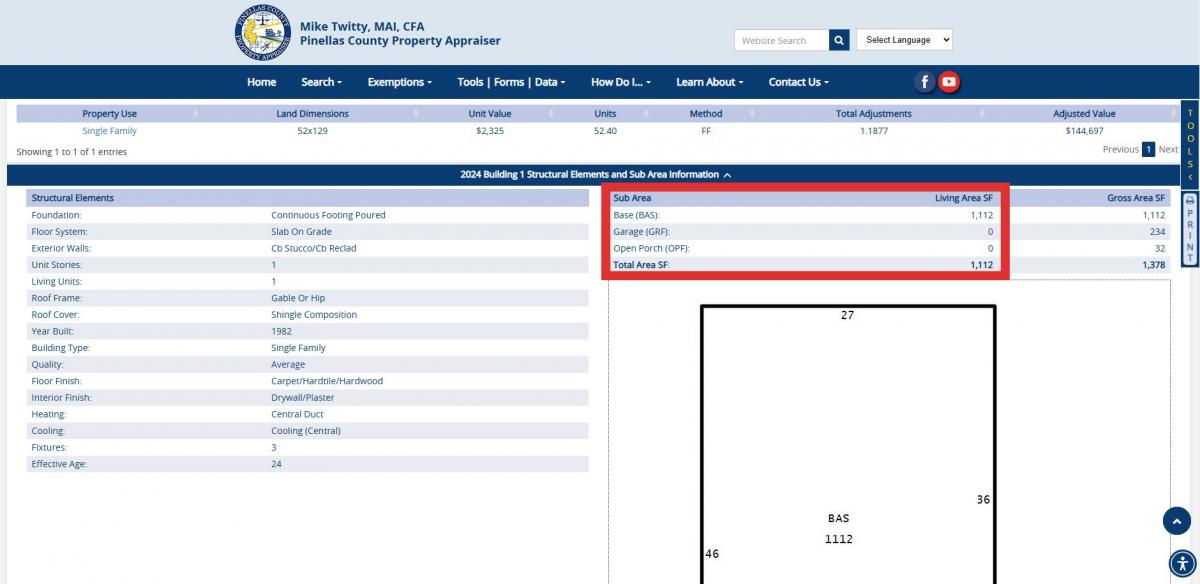

For the purpose of the calamity calculation, the square feet of living area includes the heated/cooled areas of the original structure (Subareas: BAS, BSF, USF, LAA in all homes and LAF in homes built prior to 1975).

Affected homesteaded property owners have 5 years from the January 1 following the damage or destruction of the property to commence the changes, additions, or improvements. Non-homestead property owners have 3 years from the January 1. The commencement date is triggered by pulling a building permit.

- The following information explains how the Property Appraiser determines when square footage exceeds the square footage calamity allowance:

- All areas of a structure designated as either BAS, BSF, USF, and LAA are added together and multiplied by the applicable calamity allowance percentage (110% for non-homestead and homestead completed before 2025, or 130% for homestead completed 2025 or later), to arrive at the living area allowed without going over the assessed value cap. Any area exceeding the calamity allowance would be added as new construction above the capped (assessed) value, resulting in an increase to the property taxes owed.

- The square footage of each subarea can be found on our website (https://www.pcpao.gov) by searching for the property and navigating to the Building Information section on the Property Details page. See the example (Ex:1) below.

- Ex:1

If you have more questions regarding storm damage, please visit our Storm Damage FAQs page.